COVID 19: UK Property Market Insight – Apr 2020

15/04/20 by NADAV ALBIN

Property Market

The spread of COVID-19 is very much a global crisis now and has

caused local governments to enforce varying levels of restrictions on their

populations not seen outside of war time. In the short term, this uncertainty has

hit global financial markets with the medium to long-term implications being

largely driven by how long restrictions and social distancing measures stay in

place for.

Although the future impacts are largely unknown, governments have reacted quickly to the virus and both monetary and fiscal stimulus packages have been introduced by many countries in order to avoid a repeat of the Global Financial Crisis in 2008 where credit lines ultimately dried up and constricted economies. These packages, although still early on, seem to have kept economies ticking over as best they can whilst the virus is fought through social distancing.

Utilising the research articles published by industry leaders, we are able to assess how COVID-19 may affect the UK real estate market. We also look to countries which have been able to control the spread of the virus to see how they are dealing with life after lockdown, and how a post lockdown real estate market may look in the UK.

RESIDENTIAL MARKET

TRANSACTIONS

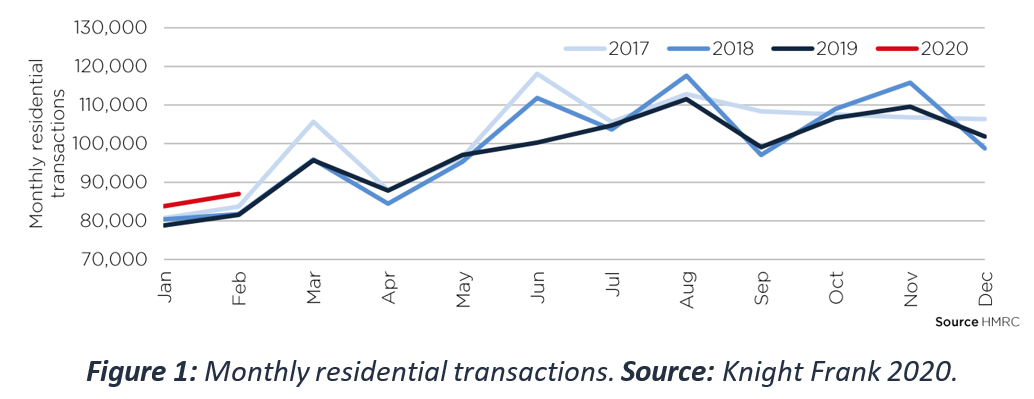

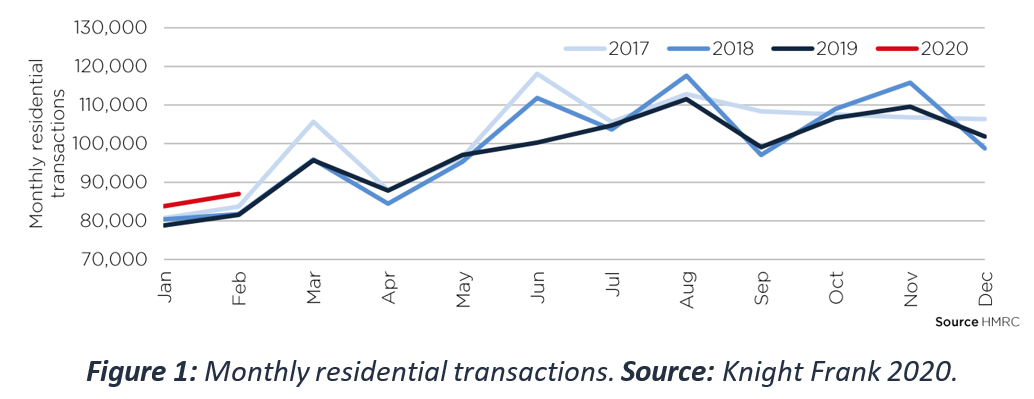

Prior to COVID-19, political uncertainty surrounding Brexit negatively impacted transaction volume within the residential market as the decision to purchase a new property was delayed. December’s election brought about a sense of certainty and the “Boris Bounce” resulted in increased activity. Many leading estate agents, including Knight Frank, estimated that 2020 would see higher transaction volumes – around 5% higher than the 5-year average[i] - shown by a strong start in 2020 sales activity below.

Short term impact

The spread of COVID-19 will likely have impacts on the UK residential housing market transactions as uncertainty weighs on consumer sentiment in the short term. To add to this, recent falls in the stock markets could also make people feel less secure about their wealth. Overall, the impact on earnings, wealth and employment will be significant in the short term, which will likely lead to less activity.

Additionally, the current movement restrictions have significantly impacted sales volumes as viewings are postponed and surveyors are unable to value properties to process mortgage applications. If transactions are to fall between 20%-40% of the five-year average by June, then this would represent an overall fall of 38%-53% compared to last year.

Long term impact

Savills outline that supressed transaction volumes will likely lead to a build-up of latent demand and the impact should therefore be short lived, especially as there has been a strong degree of pent up demand over the last two years incurred by political uncertainty[ii]. In addition, social distancing measures and working from home will further highlight the desire to move for individuals such as first-time buyers and those trading up.

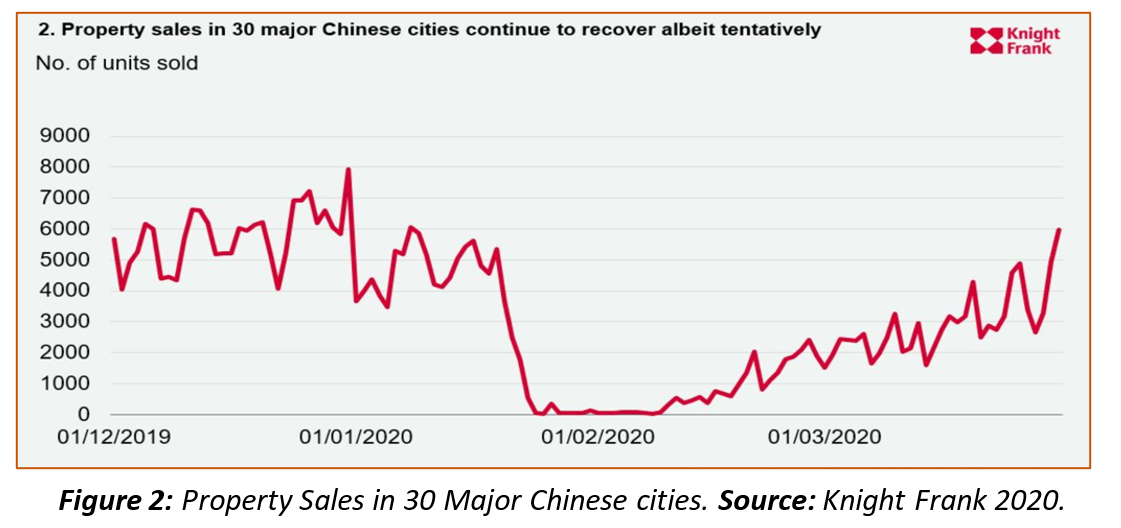

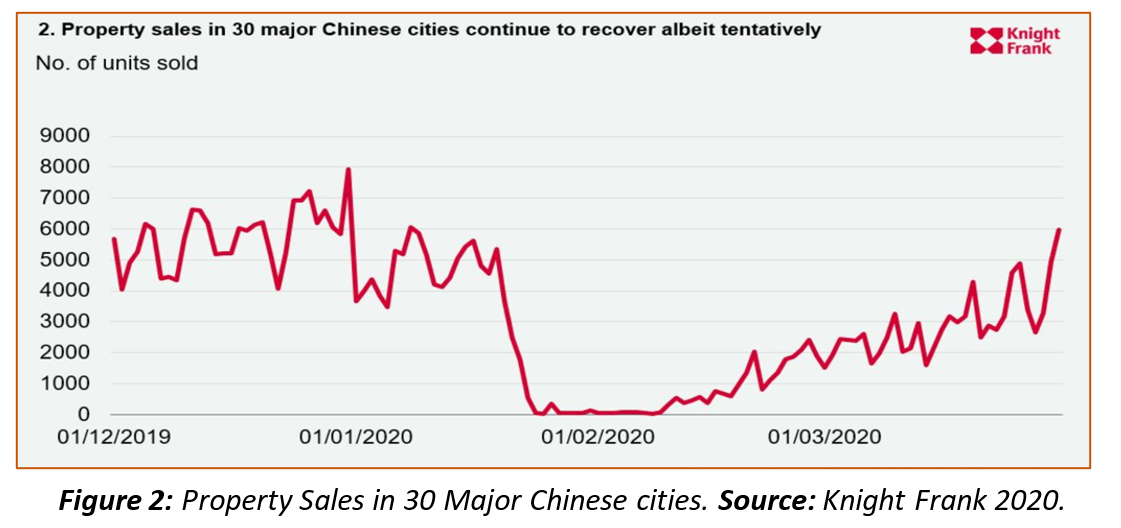

Looking ahead, in China, three weeks after the lockdown was introduced, transactions were close to zero but rebounded to around 40% of the four-year average two months after measures were first introduced[iii]. This can be seen in Figure 2 below.

PROPERTY PRICES

Short term impact

The movement restrictions and decreased confidence may ultimately lead to a short term fall in UK property prices. Although it is too soon to call, JLL believe that weaker economic activity in the first half of 2020, weakened consumer sentiment and the dislocation of jobs will negatively impact price levels.

Knight Frank expect a relatively sharp decrease in sales prices that will result in a fall of 3% in 2020, with prime central London remaining relatively unchanged due to the decrease experienced over the recent years.

Long term impact

The finite timespan of the crisis will mean declines are limited[iv]. Knight Frank expect prices to recover sharply in 2021 and expect some regions, such as prime central London, to increase by up to 8%i.

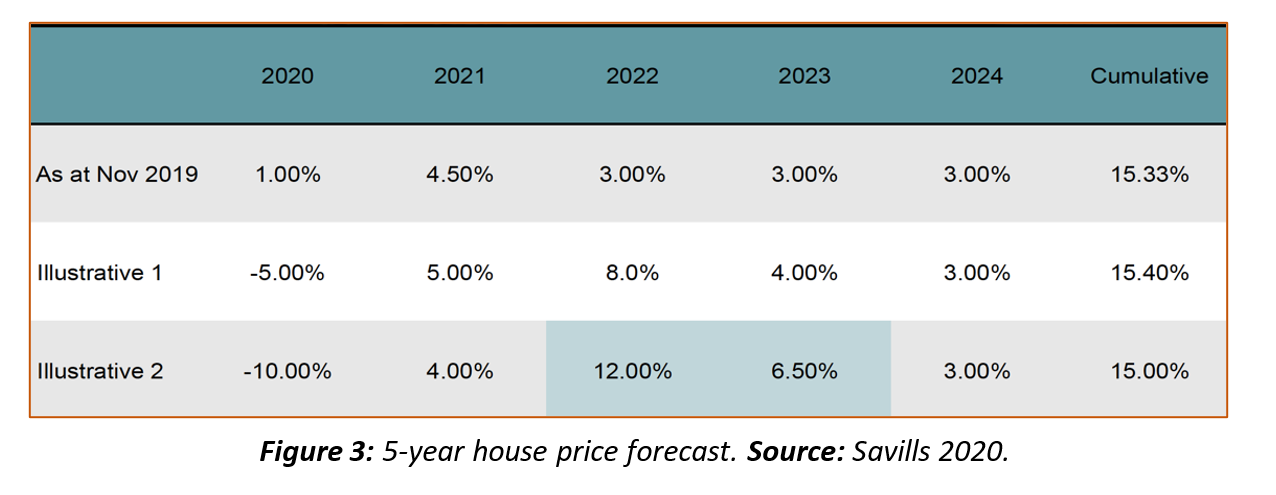

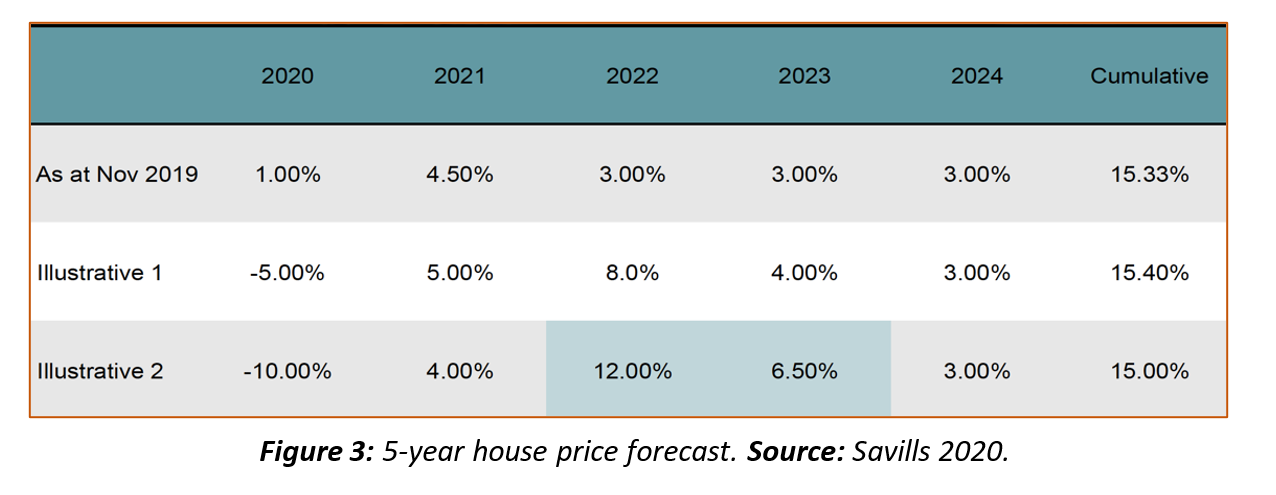

Research undertaken by Savills mirrors this view, as outlined by Figure 3 below. Illustrative 1 is based upon transactions falling to 40% of the five year average by June, increasing to 80% in January 2021 and 110% by 2022. Illustrative 2 is based upon transactions falling to 20% of the five year average by June, increasing to 60% in January 2021 and 100% by 2022.

RENTAL ACCOMMODATION

Short term impact

The impact to the residential rental market is expected to be less significant than the sales market. The Government has introduced measures, such as mortgage payment holidays for private landlords whose tenants are in financial difficulty, to help support the private rented sector (“PRS”). Savills expect rental payments to continue as usual[v] and thus no significant impact in the short term.

Long term impact

As rental values are linked to wage growth, there will likely be a slower increase in rental values over the next year, accelerating thereafter[vi]. As PRS assets are defensive in nature, and private landlords are increasingly leaving the sector due to recent government legislation making it harder to operate, institutional investors’ appetite for PRS assets continues to grow.

The impact on such investors’ will likely be minimal as the undersupply of rental accommodation caused by the exit of private landlords will continue, and standing stock from major house builders caused by a fall in residential demand will provide bulk purchase opportunities.

Residential summary

The impacts of COVID-19 on the UK residential market will likely be short lived. Pent up demand should make up for lost sales during the first two quarters of 2020 and house prices should recover, and potentially grow over the next 12-18 months. Schemes which do not rely upon overseas demand should come out strongly as domestic demand continues.

As an asset class, PRS remains attractive for institutional investors as they have defensive capabilities with stable cashflows and demand which is resilient to economic shocks[vii], as people still need a place to live.

As the pound has weakened, it may increase institutional investment into PRS from equity based funds who remain relatively unphased by the global economic situation, especially as the differential between real estate and bond yields remain at or near to an all-time high.

PURPOSE BUILT STUDENT ACCOMMODATION (“PBSA”)

PBSA has become an increasingly attractive asset in recent years, so much so that investment into PBSA increased by 250% between 2018-2019[viii]. However, COVID-19 will likely have an impact on PBSA, both on the short term and long term.

Short term impact

Universities have now closed with teaching moving online. University operators are under increasing pressure from students to suspend rent collection during this period as many students have opted to move back home during the lockdown[ix]. This will likely result in a reduction in rent collection during the period of restriction which Savills believe will expand to include out-of-term income during the summer months.

JLL suggest that the academic year may start later in January 2021 which would further impact rental values in the short term as expectations regarding investments do not meet reality. Should the academic year start in September, online-based learning will likely be adopted which could result in a lower tenant uptake as the need to be near campus diminishes.

Finally, there will likely be a reduction in the number of international students onboarding for the 20/21 academic year which will result in a reduction in overall occupancy and thus rental values.

Long term impact

Although the short-term impact is sharp, PBSA still stands as an attractive asset to institutional investors. Demand from domestic students will continue to thrive and in the longer term, demand from international students is set to increase, rising from 5 million to 8 million by 2025[x].

PBSA is still undersupplied in Europe, especially within the UK. As the UK has numerous world-class universities and remains a destination for overseas students, with increased uptake expected from China and India once travel restrictions are lifted, institutional investment into PBSA is projected to continue and strengthen.

RETIREMENT LIVING

Short term impact

Much like the residential sector, activity within the retirement living sector has ground to a halt, especially considering that senior citizens are amongst the most vulnerable groups of those affected by coronavirus. This was reflected by McCarthy & Stone's, a leading provider of retirement living, share price falling by around 70% in March 2020[xi].

Operators will also face significant short-term impacts as they impose stricter hygiene and safety measures to safeguard their tenants which will result in significantly higher occupational costs and reduce profitability in the short term[vii].

Long term impact

The retirement sector still remains a significantly undersupplied area of the UK property market. Research carried out by the Elderly Accommodation Counsel (EAC) indicates that there are only 730,000 retirement units across the UK, with around 52% of the units being built or renovated over 30 years ago[xii]. According to Knight Frank, based upon 25% of those aged 65 and over who would consider downsizing alone, an extra three million retirement properties will be required to meet the demand created by 2030.

Furthermore, senior citizens who are currently living alone during the lockdown period may be suffering from an intensified feeling of loneliness which may increase the desire to relocate to a retirement community, potentially increasing future demand.

One thing that will certainty change is the emphasis on hygiene, safety and pandemic management for future developments, asset acquisitions and existing operational assets.

OFFICE

Short term impact

The impact varies across the different type of offices within the market. Although UK office occupancy levels have been high, the outbreak could put increased pressure on landlords and operators who utilise short term leases, especially those operating flexible office and co-working space.

Office space utilisation has drastically fallen as the vast majority of individuals are effectively working from home, which may lead to many individuals, start-ups and corporates cancelling their short-term leases which will truly test the flexible office model.

Long term impact

As we are in the midst of the largest work from home experiment ever undertaken, individuals and companies are forced to drive efficiency when working remotely which will undoubtedly change the future commercial property landscape.

Ultimately, the long-term impacts are largely driven by the duration of lock down measures. As domestic measures have been lifted in China, many office spaces have since re-opened and demand for office space is seeping back into the market[xiii], with a higher emphasis on flexible office space in light of recent events. However, huge uncertainty remains as to how long restrictions are imposed within the UK, which will ultimately decide the fate for many office providers.

Overall, once the situation subsides and domestic travel recommences, the focus will largely be on flexible office space which provides the ability to reduce the floor space required as an increased number of companies will allow individuals to work remotely. Good quality office space is also in short supply, so investment into this specific space will likely continue[xiv].

RETAIL

Prior to the spread of COVID-19, the retail sector was already under significant strain from a changing landscape as consumers increasingly moved online, resulting in a slow death of the high street. The impact of coronavirus has exacerbated the underlying conditions, further impacting retail property.

Short term impact

Government imposed restrictions have severely impacted retailers as all non-essential shops have been forced to shut, which has proved to be the last straw for those retailers already suffering - highlighted by Debenhams filing for administration last week. As shops remain closed, revenue generation is limited for all except those who have an established infrastructure to facilitate online orders.

As a result, many retailers have held back rent. Hammerson, who owns centres like the Bullring in Birmingham, only received 37% of rents for Q2. Intu, another major owner of shopping centres, received a mere 29% of rents due for Q2[xv], highlighting the increased risk associated with owning retail property. The type of tenants holding back rent is not limited to small retailers as Primark[xvi], JD Sports[xvii] and Burger King are a few of the larger corporates holding back rent.

Commercial landlords argue that this is manipulation of Government measures which allow commercial tenants to delay rental payments without fear of eviction for up to three months, which instead, has resulted in tenants refusing to pay rent. The current uncertainty surrounding the retail sector has resulted in a difficulty when valuing retail assets which will likely result in a lower investment volume compared to the average.

Conversely, retailers selling perishables, dry goods and essential items have experienced an exponential increase in demand which has fuelled record revenues[vii]. The impact across different types of tenants within the retail sector has therefore been disproportionate.

Long term impact

The long-term impact of coronavirus on the retail sector will largely be driven by the financial strength of the underlying tenant, flexibility of the commercial landlord and ability to adapt in an already changing landscape.

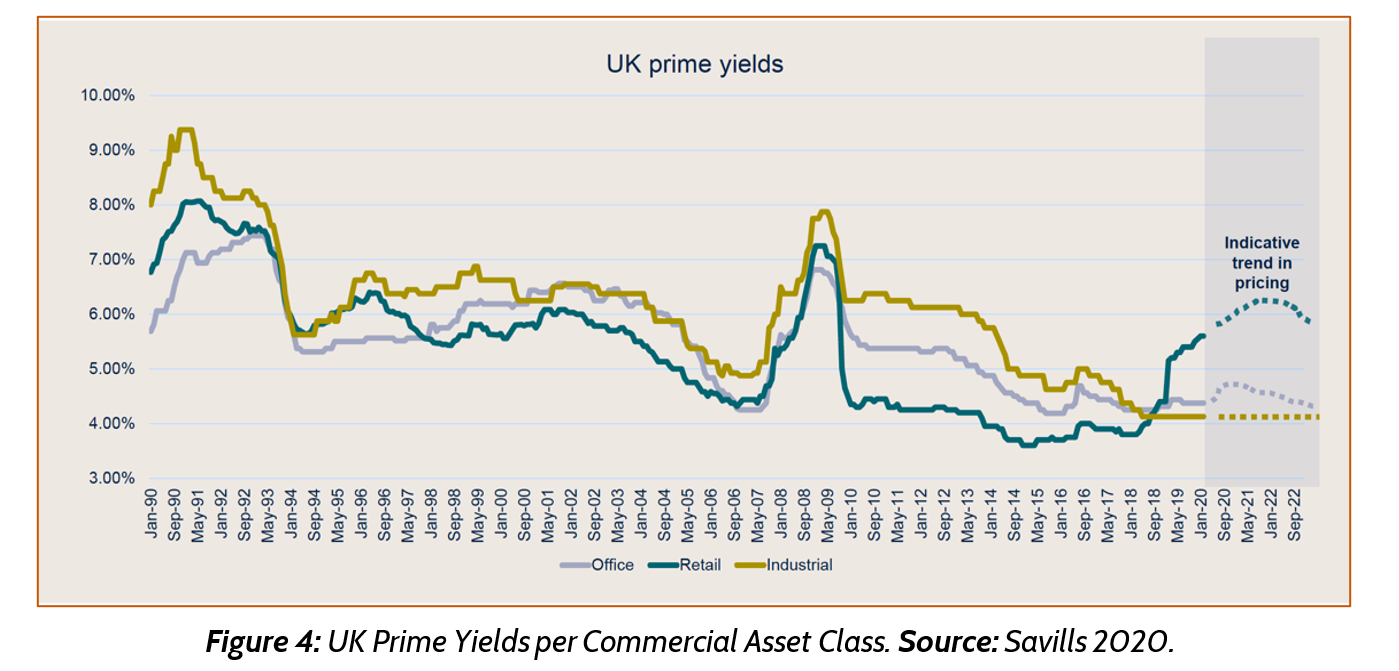

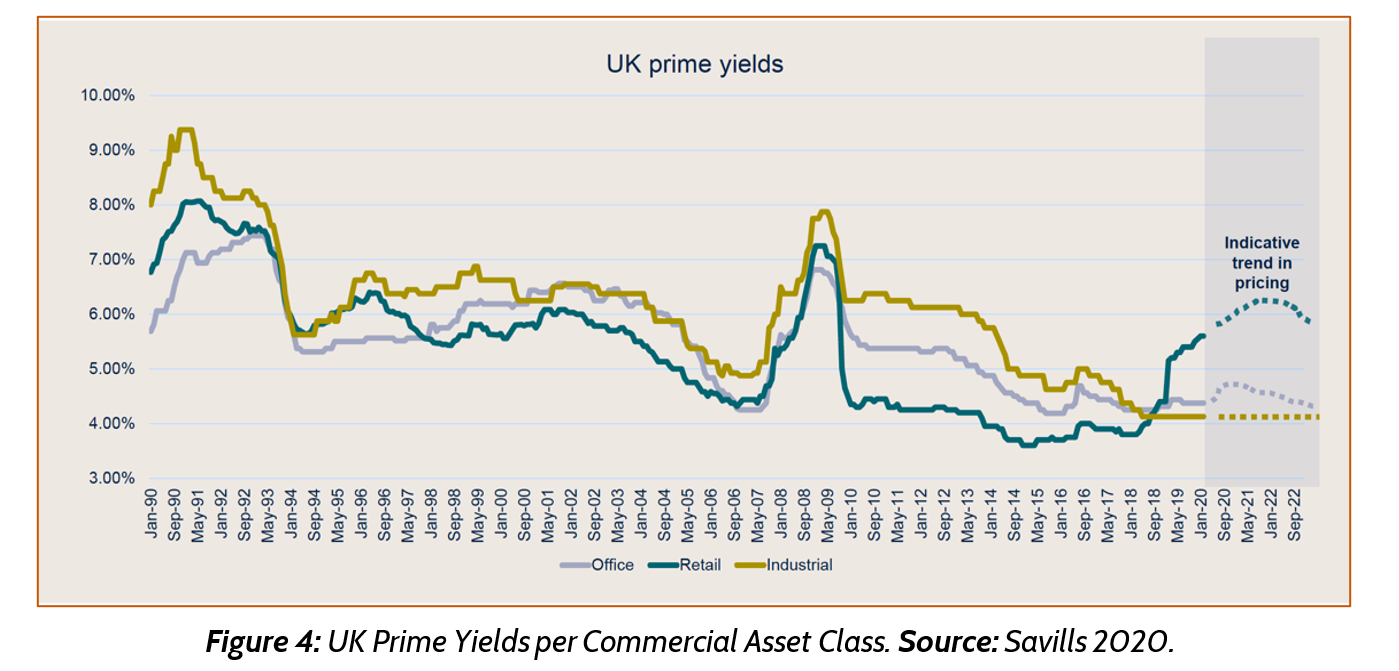

According to Savills, investment volume will likely weaken, leading to pressure on pricing and yields increasing, allowing for more opportunistic investors to return and acquire distressed assets once the implications are truly understood. Conversely, food stores will experience strengthened demand as they re-assert themselves as distress-proof assets.

JLL outline that greater emphasis will need to be placed on a flexible omni-channel model and strengthened partnerships between landlords and retailers for tenants to survive. In addition, retailers will have to re-think their supply chain model to ensure they are future proofed against any potential shocks. As online shopping will continue to grow as a result of wide-spread adoption during the lockdown period, demand for logistics space and repurposing of existing store networks will likely be boosted.

WAREHOUSE AND LOGISTICS

Short term impact

According to a survey conducted by RetailX, around 27% of respondents say that they have stopped shopping instore and have moved online[xviii]. Certain online platforms, such as supermarkets, have experienced exponential demand, putting a strain on their existing infrastructure as they struggle. Short term impacts are largely driven by supply side responses, with supply networks cracking under pressure.

Disruption to supply chains will negatively impact warehousing and logistics in the short term. Contraction in China’s manufacturing sector has caused a reduction in supply. In addition, a reduction in activity in major global gateways will reduce the amount of inventory in already impacted areas[vii]. JLL suggest that this may lead to falling utilisation rates for logistics, as well as a short-term fall in warehouse capacity utilisation, especially amongst those fulfilling short-term excess.

Enhancing the effect, a reduction within the manufacturing sector as a result of social distancing measures and supply side issues has further reduced the utilisation of warehousing space. Ultimately, tenants will have to work with landlords to agree rent holidays in the short term[xix]. Alternatively, Savills outline that tenant failure may increase which could lead to increased second-hand supply towards the tail end of the year.

Long term impact

Retailers will aim to improve flexibility to meet uncertain spikes in demand or mitigate supply-side chain issues by reshoring or near sourcing manufacturing. This will likely increase the demand for regional warehousing and logistic space[vii]. In addition, firms may reverse the lean inventory cover in place and stock more items to overcome long term uncertainty and disruption which will likely fuel further demand for warehousing and logistic space.

The shift towards online e-commerce will be accelerated by the spread of COVID-19. Online sales within Western Europe are expected to increase from 11.8% of total retail sales in 2019 to 17.8% by 2024[xx]. Savills outline that, assuming industry standards of 75,000 sqm space for every €1bn spent online, an additional 16.7sqm of logistic facilities in Western Europe will be required.

Investment into improving the operational efficiency of logistics and warehouses will likely increase as a result of recent events showing cracks in many companies’ supply networks. For example, investment into robotics will likely be adopted by many firms as part of their long-term strategies. According to JLL, this could influence the future design of warehouses which may have smaller carbon and physical footprints as less car parking spaces are required. Adoption of robots will also mean that labour is less important than power, fueling further change to the commercial real estate landscape.

RISKS AND OPPORTUNITIES

In many respects, it is too early to estimate the full economic and property impact of COVID-19. 2019’s US/China trade wars and Brexit have also muddied the waters when determining the true impact on the UK property market.

Overall, the effects of COVID-19 are disproportionate across the different UK property sectors. Any significant impacts should be relatively short lived, giving way to opportunity in the long term. Existing trends will continue to strengthen and accelerate, such as the increase in online customers and e-commerce. Cracks in existing supply-chains and infrastructure will deepen in the short term which will likely lead to more investment into the sector to ensure that networks underpinning commercial property will be more efficient and have in-built flexibility as stakeholders wish to future proof their assets.

As highlighted in a recent BISNOW podcast with Bei Capital’s founder, Colin Lau, there is a consensus that the issues of COVID-19 will create long lasting lessons. Owners and operators of real estate will have to be imaginative about how they reinstill confidence to draw tenants back. Hygiene, sanitation and safety will be a much larger focus for existing assets which will likely increase future operational expenditure. However, it also opens up the possibility for measures to be in-built into future developments by utilising specific materials in key contact points that limit the spread of bacteria and viruses.

Future developments may also be reimagined with enhanced emphasis on mixed-use developments, ensuring that people are able to retain a standard level of wellbeing whilst being in close proximity to essential goods and services. Although the short-term negative impacts of COVID-19 should be relatively short-lived, it will have long lasting effects about how we develop and reimagine property and how individuals interact with the built environment, accelerating existing trends and innovating others.

SOURCES

Although the future impacts are largely unknown, governments have reacted quickly to the virus and both monetary and fiscal stimulus packages have been introduced by many countries in order to avoid a repeat of the Global Financial Crisis in 2008 where credit lines ultimately dried up and constricted economies. These packages, although still early on, seem to have kept economies ticking over as best they can whilst the virus is fought through social distancing.

Utilising the research articles published by industry leaders, we are able to assess how COVID-19 may affect the UK real estate market. We also look to countries which have been able to control the spread of the virus to see how they are dealing with life after lockdown, and how a post lockdown real estate market may look in the UK.

RESIDENTIAL MARKET

TRANSACTIONS

Prior to COVID-19, political uncertainty surrounding Brexit negatively impacted transaction volume within the residential market as the decision to purchase a new property was delayed. December’s election brought about a sense of certainty and the “Boris Bounce” resulted in increased activity. Many leading estate agents, including Knight Frank, estimated that 2020 would see higher transaction volumes – around 5% higher than the 5-year average[i] - shown by a strong start in 2020 sales activity below.

Short term impact

The spread of COVID-19 will likely have impacts on the UK residential housing market transactions as uncertainty weighs on consumer sentiment in the short term. To add to this, recent falls in the stock markets could also make people feel less secure about their wealth. Overall, the impact on earnings, wealth and employment will be significant in the short term, which will likely lead to less activity.

Additionally, the current movement restrictions have significantly impacted sales volumes as viewings are postponed and surveyors are unable to value properties to process mortgage applications. If transactions are to fall between 20%-40% of the five-year average by June, then this would represent an overall fall of 38%-53% compared to last year.

Long term impact

Savills outline that supressed transaction volumes will likely lead to a build-up of latent demand and the impact should therefore be short lived, especially as there has been a strong degree of pent up demand over the last two years incurred by political uncertainty[ii]. In addition, social distancing measures and working from home will further highlight the desire to move for individuals such as first-time buyers and those trading up.

Looking ahead, in China, three weeks after the lockdown was introduced, transactions were close to zero but rebounded to around 40% of the four-year average two months after measures were first introduced[iii]. This can be seen in Figure 2 below.

PROPERTY PRICES

Short term impact

The movement restrictions and decreased confidence may ultimately lead to a short term fall in UK property prices. Although it is too soon to call, JLL believe that weaker economic activity in the first half of 2020, weakened consumer sentiment and the dislocation of jobs will negatively impact price levels.

Knight Frank expect a relatively sharp decrease in sales prices that will result in a fall of 3% in 2020, with prime central London remaining relatively unchanged due to the decrease experienced over the recent years.

Long term impact

The finite timespan of the crisis will mean declines are limited[iv]. Knight Frank expect prices to recover sharply in 2021 and expect some regions, such as prime central London, to increase by up to 8%i.

Research undertaken by Savills mirrors this view, as outlined by Figure 3 below. Illustrative 1 is based upon transactions falling to 40% of the five year average by June, increasing to 80% in January 2021 and 110% by 2022. Illustrative 2 is based upon transactions falling to 20% of the five year average by June, increasing to 60% in January 2021 and 100% by 2022.

RENTAL ACCOMMODATION

Short term impact

The impact to the residential rental market is expected to be less significant than the sales market. The Government has introduced measures, such as mortgage payment holidays for private landlords whose tenants are in financial difficulty, to help support the private rented sector (“PRS”). Savills expect rental payments to continue as usual[v] and thus no significant impact in the short term.

Long term impact

As rental values are linked to wage growth, there will likely be a slower increase in rental values over the next year, accelerating thereafter[vi]. As PRS assets are defensive in nature, and private landlords are increasingly leaving the sector due to recent government legislation making it harder to operate, institutional investors’ appetite for PRS assets continues to grow.

The impact on such investors’ will likely be minimal as the undersupply of rental accommodation caused by the exit of private landlords will continue, and standing stock from major house builders caused by a fall in residential demand will provide bulk purchase opportunities.

Residential summary

The impacts of COVID-19 on the UK residential market will likely be short lived. Pent up demand should make up for lost sales during the first two quarters of 2020 and house prices should recover, and potentially grow over the next 12-18 months. Schemes which do not rely upon overseas demand should come out strongly as domestic demand continues.

As an asset class, PRS remains attractive for institutional investors as they have defensive capabilities with stable cashflows and demand which is resilient to economic shocks[vii], as people still need a place to live.

As the pound has weakened, it may increase institutional investment into PRS from equity based funds who remain relatively unphased by the global economic situation, especially as the differential between real estate and bond yields remain at or near to an all-time high.

PURPOSE BUILT STUDENT ACCOMMODATION (“PBSA”)

PBSA has become an increasingly attractive asset in recent years, so much so that investment into PBSA increased by 250% between 2018-2019[viii]. However, COVID-19 will likely have an impact on PBSA, both on the short term and long term.

Short term impact

Universities have now closed with teaching moving online. University operators are under increasing pressure from students to suspend rent collection during this period as many students have opted to move back home during the lockdown[ix]. This will likely result in a reduction in rent collection during the period of restriction which Savills believe will expand to include out-of-term income during the summer months.

JLL suggest that the academic year may start later in January 2021 which would further impact rental values in the short term as expectations regarding investments do not meet reality. Should the academic year start in September, online-based learning will likely be adopted which could result in a lower tenant uptake as the need to be near campus diminishes.

Finally, there will likely be a reduction in the number of international students onboarding for the 20/21 academic year which will result in a reduction in overall occupancy and thus rental values.

Long term impact

Although the short-term impact is sharp, PBSA still stands as an attractive asset to institutional investors. Demand from domestic students will continue to thrive and in the longer term, demand from international students is set to increase, rising from 5 million to 8 million by 2025[x].

PBSA is still undersupplied in Europe, especially within the UK. As the UK has numerous world-class universities and remains a destination for overseas students, with increased uptake expected from China and India once travel restrictions are lifted, institutional investment into PBSA is projected to continue and strengthen.

RETIREMENT LIVING

Short term impact

Much like the residential sector, activity within the retirement living sector has ground to a halt, especially considering that senior citizens are amongst the most vulnerable groups of those affected by coronavirus. This was reflected by McCarthy & Stone's, a leading provider of retirement living, share price falling by around 70% in March 2020[xi].

Operators will also face significant short-term impacts as they impose stricter hygiene and safety measures to safeguard their tenants which will result in significantly higher occupational costs and reduce profitability in the short term[vii].

Long term impact

The retirement sector still remains a significantly undersupplied area of the UK property market. Research carried out by the Elderly Accommodation Counsel (EAC) indicates that there are only 730,000 retirement units across the UK, with around 52% of the units being built or renovated over 30 years ago[xii]. According to Knight Frank, based upon 25% of those aged 65 and over who would consider downsizing alone, an extra three million retirement properties will be required to meet the demand created by 2030.

Furthermore, senior citizens who are currently living alone during the lockdown period may be suffering from an intensified feeling of loneliness which may increase the desire to relocate to a retirement community, potentially increasing future demand.

One thing that will certainty change is the emphasis on hygiene, safety and pandemic management for future developments, asset acquisitions and existing operational assets.

OFFICE

Short term impact

The impact varies across the different type of offices within the market. Although UK office occupancy levels have been high, the outbreak could put increased pressure on landlords and operators who utilise short term leases, especially those operating flexible office and co-working space.

Office space utilisation has drastically fallen as the vast majority of individuals are effectively working from home, which may lead to many individuals, start-ups and corporates cancelling their short-term leases which will truly test the flexible office model.

Long term impact

As we are in the midst of the largest work from home experiment ever undertaken, individuals and companies are forced to drive efficiency when working remotely which will undoubtedly change the future commercial property landscape.

Ultimately, the long-term impacts are largely driven by the duration of lock down measures. As domestic measures have been lifted in China, many office spaces have since re-opened and demand for office space is seeping back into the market[xiii], with a higher emphasis on flexible office space in light of recent events. However, huge uncertainty remains as to how long restrictions are imposed within the UK, which will ultimately decide the fate for many office providers.

Overall, once the situation subsides and domestic travel recommences, the focus will largely be on flexible office space which provides the ability to reduce the floor space required as an increased number of companies will allow individuals to work remotely. Good quality office space is also in short supply, so investment into this specific space will likely continue[xiv].

RETAIL

Prior to the spread of COVID-19, the retail sector was already under significant strain from a changing landscape as consumers increasingly moved online, resulting in a slow death of the high street. The impact of coronavirus has exacerbated the underlying conditions, further impacting retail property.

Short term impact

Government imposed restrictions have severely impacted retailers as all non-essential shops have been forced to shut, which has proved to be the last straw for those retailers already suffering - highlighted by Debenhams filing for administration last week. As shops remain closed, revenue generation is limited for all except those who have an established infrastructure to facilitate online orders.

As a result, many retailers have held back rent. Hammerson, who owns centres like the Bullring in Birmingham, only received 37% of rents for Q2. Intu, another major owner of shopping centres, received a mere 29% of rents due for Q2[xv], highlighting the increased risk associated with owning retail property. The type of tenants holding back rent is not limited to small retailers as Primark[xvi], JD Sports[xvii] and Burger King are a few of the larger corporates holding back rent.

Commercial landlords argue that this is manipulation of Government measures which allow commercial tenants to delay rental payments without fear of eviction for up to three months, which instead, has resulted in tenants refusing to pay rent. The current uncertainty surrounding the retail sector has resulted in a difficulty when valuing retail assets which will likely result in a lower investment volume compared to the average.

Conversely, retailers selling perishables, dry goods and essential items have experienced an exponential increase in demand which has fuelled record revenues[vii]. The impact across different types of tenants within the retail sector has therefore been disproportionate.

Long term impact

The long-term impact of coronavirus on the retail sector will largely be driven by the financial strength of the underlying tenant, flexibility of the commercial landlord and ability to adapt in an already changing landscape.

According to Savills, investment volume will likely weaken, leading to pressure on pricing and yields increasing, allowing for more opportunistic investors to return and acquire distressed assets once the implications are truly understood. Conversely, food stores will experience strengthened demand as they re-assert themselves as distress-proof assets.

JLL outline that greater emphasis will need to be placed on a flexible omni-channel model and strengthened partnerships between landlords and retailers for tenants to survive. In addition, retailers will have to re-think their supply chain model to ensure they are future proofed against any potential shocks. As online shopping will continue to grow as a result of wide-spread adoption during the lockdown period, demand for logistics space and repurposing of existing store networks will likely be boosted.

WAREHOUSE AND LOGISTICS

Short term impact

According to a survey conducted by RetailX, around 27% of respondents say that they have stopped shopping instore and have moved online[xviii]. Certain online platforms, such as supermarkets, have experienced exponential demand, putting a strain on their existing infrastructure as they struggle. Short term impacts are largely driven by supply side responses, with supply networks cracking under pressure.

Disruption to supply chains will negatively impact warehousing and logistics in the short term. Contraction in China’s manufacturing sector has caused a reduction in supply. In addition, a reduction in activity in major global gateways will reduce the amount of inventory in already impacted areas[vii]. JLL suggest that this may lead to falling utilisation rates for logistics, as well as a short-term fall in warehouse capacity utilisation, especially amongst those fulfilling short-term excess.

Enhancing the effect, a reduction within the manufacturing sector as a result of social distancing measures and supply side issues has further reduced the utilisation of warehousing space. Ultimately, tenants will have to work with landlords to agree rent holidays in the short term[xix]. Alternatively, Savills outline that tenant failure may increase which could lead to increased second-hand supply towards the tail end of the year.

Long term impact

Retailers will aim to improve flexibility to meet uncertain spikes in demand or mitigate supply-side chain issues by reshoring or near sourcing manufacturing. This will likely increase the demand for regional warehousing and logistic space[vii]. In addition, firms may reverse the lean inventory cover in place and stock more items to overcome long term uncertainty and disruption which will likely fuel further demand for warehousing and logistic space.

The shift towards online e-commerce will be accelerated by the spread of COVID-19. Online sales within Western Europe are expected to increase from 11.8% of total retail sales in 2019 to 17.8% by 2024[xx]. Savills outline that, assuming industry standards of 75,000 sqm space for every €1bn spent online, an additional 16.7sqm of logistic facilities in Western Europe will be required.

Investment into improving the operational efficiency of logistics and warehouses will likely increase as a result of recent events showing cracks in many companies’ supply networks. For example, investment into robotics will likely be adopted by many firms as part of their long-term strategies. According to JLL, this could influence the future design of warehouses which may have smaller carbon and physical footprints as less car parking spaces are required. Adoption of robots will also mean that labour is less important than power, fueling further change to the commercial real estate landscape.

RISKS AND OPPORTUNITIES

In many respects, it is too early to estimate the full economic and property impact of COVID-19. 2019’s US/China trade wars and Brexit have also muddied the waters when determining the true impact on the UK property market.

Overall, the effects of COVID-19 are disproportionate across the different UK property sectors. Any significant impacts should be relatively short lived, giving way to opportunity in the long term. Existing trends will continue to strengthen and accelerate, such as the increase in online customers and e-commerce. Cracks in existing supply-chains and infrastructure will deepen in the short term which will likely lead to more investment into the sector to ensure that networks underpinning commercial property will be more efficient and have in-built flexibility as stakeholders wish to future proof their assets.

As highlighted in a recent BISNOW podcast with Bei Capital’s founder, Colin Lau, there is a consensus that the issues of COVID-19 will create long lasting lessons. Owners and operators of real estate will have to be imaginative about how they reinstill confidence to draw tenants back. Hygiene, sanitation and safety will be a much larger focus for existing assets which will likely increase future operational expenditure. However, it also opens up the possibility for measures to be in-built into future developments by utilising specific materials in key contact points that limit the spread of bacteria and viruses.

Future developments may also be reimagined with enhanced emphasis on mixed-use developments, ensuring that people are able to retain a standard level of wellbeing whilst being in close proximity to essential goods and services. Although the short-term negative impacts of COVID-19 should be relatively short-lived, it will have long lasting effects about how we develop and reimagine property and how individuals interact with the built environment, accelerating existing trends and innovating others.

SOURCES

[ii] https://www.savills.co.uk/research_articles/229130/298508-0/what-covid-19-means-for-the-uk-property-market

[vii] https://www.jll.co.uk/en/trends-and-insights/research/covid-19-global-real-estate-implications

[viii] https://www.savills.co.uk/blog/article/298631/commercial-property/how-resilient-is-the-student-housing-market-during-the-covid-19-pandemic-.aspx

[ix] https://www.propertyweek.com/residential-and-development/pbsa-sector-braces-itself-for-severe-impact-in-short-term/5107189.article

[x] https://www.savills.co.uk/blog/article/298631/commercial-property/how-resilient-is-the-student-housing-market-during-the-covid-19-pandemic-.aspx

[xi] https://www.propertyweek.com/residential-and-development/retirement-living-hit-hard-by-the-lockdown/5107193.article

[xiii] https://www.propertyweek.com/news-analysis/all-eyes-are-on-asian-flex-markets-for-a-sign-of-whats-to-come-here/5107174.article

[xv] https://www.theguardian.com/business/2020/apr/11/retail-landlords-struggling-rents-dry-up-pandemic

[xvi] https://www.theguardian.com/world/2020/mar/25/primark-withholds-33m-rent-on-its-closed-uk-stores

[xviii] https://www.knightfrank.co.uk/research/article/2020-04-03-how-is-covid19-impacting-on-the-uk-industrial-and-logistics-market