Understanding the investment lifecycle to optimise wealth

18/02/22 by Igor Gorbatsevich

Lifestyle, Investing

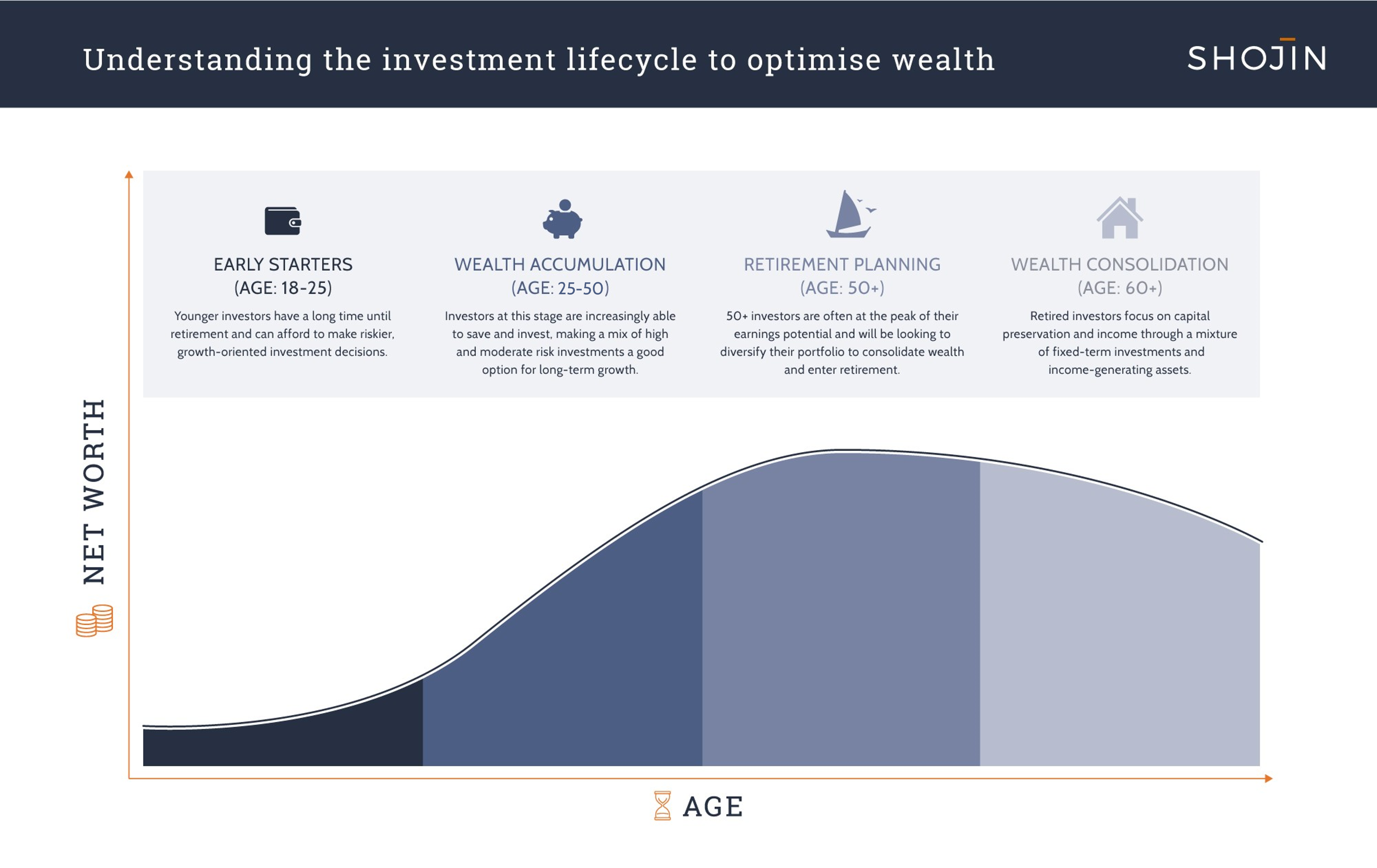

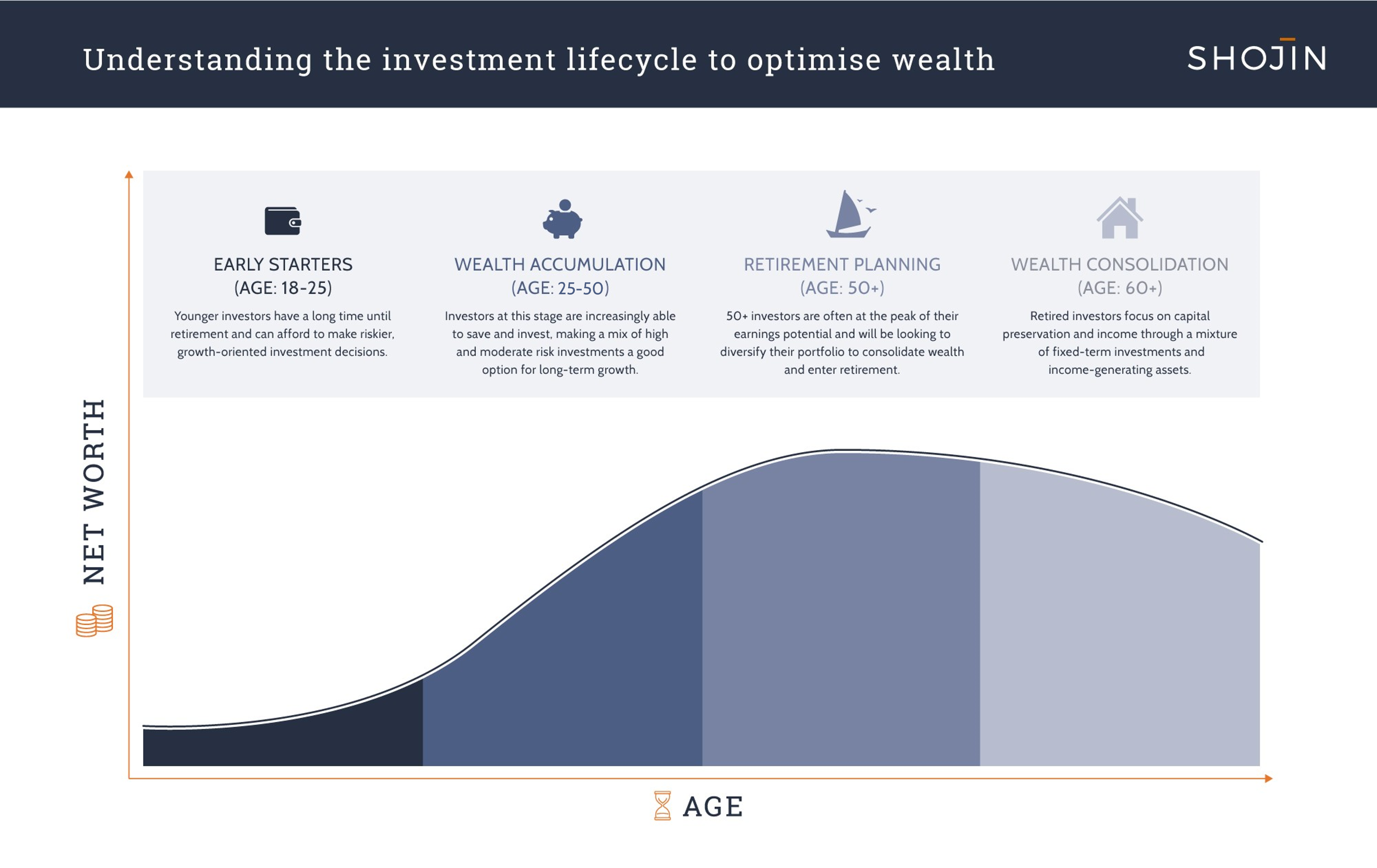

Investing is a lifelong endeavour, and it is never too late to begin preparing for your future. Even though every investor is unique, with our own goals and objectives, most of us will encounter similar situations and life stages over the years. For instance, almost all of us will one day begin our first job, we will start a family, buy a home, and one day leave our job (almost certainly not the same job as the first) to begin our retirement. These predictable (on average) phases of life provide opportunities and challenges for investors. They require different investment strategies and products, which maximise potential returns while minimising risk, depending on the time and resources available to us. By understanding these stages – known as the wealth management or investment lifecycle – we can create a personal roadmap that will improve our chances of reaching our investment goals. The wealth management lifecycle takes the guesswork out of investment decisions, and while we can’t time the market or foresee potential challenges in the future, we can formulate a solid plan to realise great returns and weather storms when they arise.

Property investing has long been a lucrative vehicle for capital gains but, until very recently, it was inaccessible to the general public, due in large part to the amount of funds needed to get involved. Now, with the rise of property crowdfunding and co-investment, a prime example of which is Shojin’s investment model, ordinary investors have access to premium property investments for all stages of the investment lifecycle. Whether you want fixed or variable returns, low risk or high risk products, short-term investments or long-term investments, property crowdfunding is the perfect asset class for adhering to the wealth management lifecycle and maximising returns while protecting your downside.

We look at the four lifecycle stages below and provide guidance on property investment products made on a fractional basis that will suit particular phases of life.

Phase 1: Early starters (18-25)

This phase is typified by young workers just out of college, or graduates taking their first job in a chosen field. Though typically in starter roles with low income, they are saving and investing funds to take care of immediate needs such as buying a car, saving for a property or paying down student loans. Portfolios at this stage are small but will rapidly grow with consistent contributions, and the long time horizon before retirement means this cohort can afford to take some risk with their investment decisions, due in large part to their ability to bounce back if a particular investment doesn’t pan out.

One of the great benefits of co-investing is that you can invest passively in projects with small amounts of capital. That’s why, at Shojin, we suggest people in this early accumulation phase diversify their portfolio with a mix of higher and moderate risk investments. Our product development Equity, for example, offers the opportunity to share in the profits of development projects, which typically run for 18 to 24 months and can deliver very strong returns in excess of 20% per annum. It is considered a medium to high risk investment suiting investors with more appetite for risk and longer timescales to reach their financial objectives.

To sit alongside this higher risk investment, we also suggest a more moderate risk asset in the form of mezzanine Loans. These loans are used by property developers who need additional capital for a construction or development project, but do not want to give away their equity and are willing to offer more security with fixed returns instead. They offer fixed annualised returns of 12-15% per annum for the investor and provide a solid bulwark against higher risk ventures.

Phase 2: Wealth accumulation (25-50)

At this stage, many investors have settled into a career and are actively working to increase their wealth. With enough time before retirement, there is still ample opportunity to invest in higher risk projects and aggressively grow their portfolios. This is also the stage of life when people begin to settle down, have a family and buy property - therefore requirements can change and liquidity can be a factor.

A portfolio weighted to riskier and higher return investments is still good for this group, but with a gradual increase of low-to-medium investments as they get older. Utilise your ISA if you are in the UK for tax free returns on some investments such as mezzanine loans via Shojin's Innovative Finance ISA (IFISA). Tax free investments can also be made within your self-managed UK pension through a SIPP or SSAS.

In this phase of the life cycle, diversification becomes even more important than before. A blend of development equity and mezzanine loans will offer the most reward and protection from downswings, with higher risk investments such as development equity gradually phased out in favour of more fixed returns as the investor nears 50.

Phase 3: Retirement planning (50+)

Many investors are now in senior positions in their respective careers, earning well. However, there is less time before retirement, and volatility in investments may not be welcome, especially in a turbulent economy (which is, unfortunately, impossible to predict). At this point, with potentially significant funds available, it is a good time to start transitioning to lower risk, mid to long-term investments, gradually shifting to fixed assets that will preserve capital and generate steady income.

At this stage in life, investment vehicles such ISAs, SIPPs and SSASs should be leveraged extensively to maximise tax free returns. One of the fantastic things about Shojin products is that they are eligible for these vehicles, making fixed and variable returns tax free for the investor. At this point we suggest portfolios to be weighted more heavily towards mezzanine loans, with some allocation to development equity and bridge loans to ensure diversification. In the past few years, we have seen many investors in this age group take a career break, which changes their investment objectives accordingly. For those in this situation, we would suggest keeping the mezzanine investments but diversifying into income generating products such as asset investments and corporate bonds.

Phase 4: Wealth consolidation (60+)

Aggressive wealth accumulation should now play a small part in the investor’s portfolio. In this period of ‘asset decumulation’ the focus should be on low risk, fixed ROI investments that will maintain your quality of life in retirement and will take care of any unforeseen expenses such as medical bills.

We recommend little, if any, investment in higher risk assets such as development equity at this stage, although we find that wealthy investors still like to keep a small allocation here. A moderate allocation to mezzanine will lock in some gains with a 12-36 month timeframe but, for the most part, the majority of the portfolio should be made up of first charge loans like bridge loans and asset investments which have solid underlying asset value and stable returns such as Purpose-Built Student Accommodation (PBSA) and Private Rental Schemes (PRS), which offer stable income in quasi-residential sectors.

Mapping your journey to the investment lifecycle is key to long-term success

The question is not whether you should invest, but how you should invest and which products you should choose. A consistent investment strategy that aligns with your age and circumstances, and is diversified to reduce risk, will offer you the best opportunity to maximise your returns over time.

As a leading property investment platform, we provide only the very best and exclusive institutional-grade real estate opportunities for our investors. Using a combination of thorough due diligence, use of technology and leveraging financial expertise, our investment products are handpicked to cater to all risk profiles and timelines, no matter where you are on the wealth management lifecycle. Using our platform, you can also access information about your investments at any time, leaving you secure in the knowledge that your portfolio is being managed by professionals with decades of experience.